portability of estate tax exemption 2019

The tax exemption change works with the federal gift and estate tax where the TCJA act doubles the existing exemption from 5 million to 10 million. For those who pass away in 2018 the current amount of 1118 million will still.

Msu Extension Montana State University

An estate tax return is lengthy.

. The tax cuts and jobs act increased the exclusion significantly. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013. Submit a written request and include proof of payment front and back of the cancelled check or the receipts from the City Register Division of Land Records showing payment and a copy of.

For 2017 the estate tax. The prior spouses exemption amount would be carried over by the surviving spouse provided a federal estate tax return on IRS Form 706 was timely filed at the first death. Portability is a new federal estate tax law provision that allows surviving spouses to use their deceased spouses unused federal estate tax exemption.

The option of estate tax exemption portability can make a significant difference when it comes to taxation of an estate. This exemption provides a reduction of up to 50 in the assessed value of the residence of qualified disabled person s Those municipalities that opt to offer the exemption. The estate tax exemption dates back to the Revenue Act of 1916 when the federal government started taxing estates valued at over 50000.

This exemption stayed in place for. Unfortunately couples that include a non-citizen non-US. 413 eliminates the wartime service requirement for the 100 Totally and Permanently Disabled Veterans Property Tax Exemption.

To make the portability election filing an estate tax return IRS Form 706 is required. Get information on how the estate tax may apply to your taxable estate at your death. The 2019 federal estate tax exemption will be 114 million.

In Maryland a law introduced in 2014 gradually increased the estate tax exemption every year until the year 2019. Increased by the decedents adjusted taxable gifts and specific gift tax exemption is valued at more than. If making a portability election a surviving spouse can have an exemption up to 228 million.

The New Jersey Division of Taxation Veteran Exemption PO Box 440 Trenton NJ. If one spouse dies before another and doesnt use 100 of hisher estate tax exemption the surviving spouse can use the remaining exemption plus hisher own exemption. 2019 Changes to Estate Tax Exemption Maryland.

The 2019 estate tax exemption will only apply to the estates of individuals passing away in 2019. The 2019 federal exemption for gift and estate taxes is 11400000 per person. The estate of a deceased non-citizen cannot elect.

Foreseeing the inflation the TCJA has. Effective December 4 2020 State law PL. By Mail - send a copy of your documentation and Veteran Income Tax Exemption Submission Form to.

Resident may not be able to take advantage of estate tax portability.

Irs Alert Update New 2020 Federal Estate Gift Tax Limits Announced By The Irs David M Frees Iii

How Changes To Portability Of The Estate Tax Exemption May Impact You Mandelbaum Barrett Pc

Illinois Estate Tax Faqs Federal Tax Exemptions For Estates

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Relief From Irs Portability Of Lifetime Tax Exemption Extended Wilchins Cosentino Novins Llp Wellesley Ma Law Firm

Estate Tax Portability You Can T Take It With You But Your Spouse Can

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Gift And Estate Tax Changes Under The Tax Cuts And Jobs Act Transfer More Wealth Tax Free Marcum Llp Accountants And Advisors

What Does Portability Of The Estate And Gift Tax Exemption Mean For You Schell Bray

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors

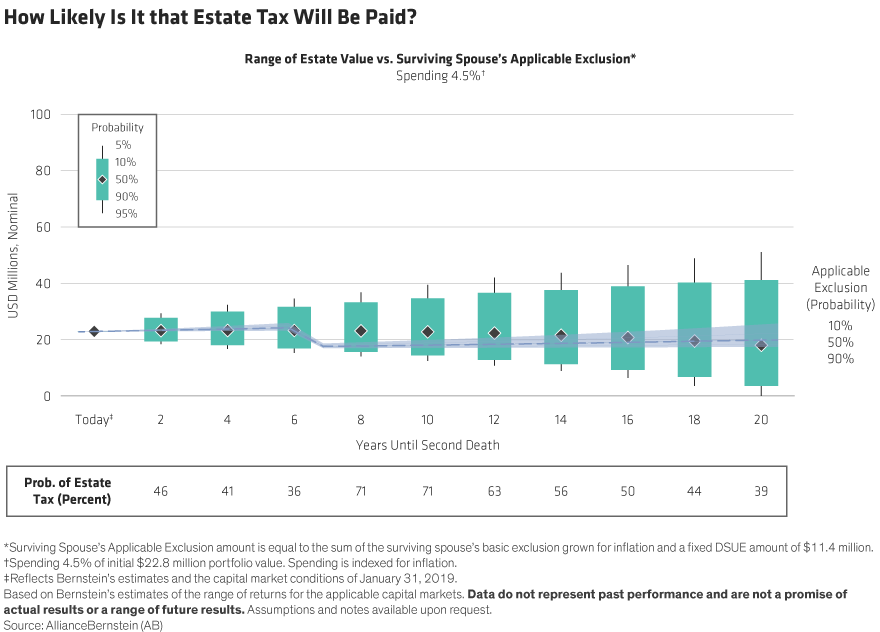

Will Your Estate Be Taxable In The Future Context Ab

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Stu Law Tax Law Symposium 2019 Panel 3 Federal Estate And Gift Tax Youtube

Estate And Gift Tax Update For 2021 Werner Law Firm

Late Portability Election New Relief Available New York Law Journal

How The Portability Provision Can Double Your Exemption From Federal Estate Tax

Irs Announces Higher 2019 Estate And Gift Tax Limits

What Is The Federal Estate Tax Sunshine Financial Solutions Insurance Retirement College Funding And Business Solutions